modified business tax return instructions

However for 202021 the default arrangement will be to submit the returns by the normal 31 March deadline following the end of the tax year in paper format. Client has nexus in this state.

INSTRUCTIONS - MODIFIED BUSINESS TAX RETURN - FINANCIAL BUSINESSES ONLY General Businesses need to use the form developed specifically for them TXR-02005.

:max_bytes(150000):strip_icc()/ScreenShot2021-02-08at3.59.40PM-9f028cea3cb545d19e4c64e10ca68a06.png)

. Nevada Department of Taxation. This notice will be sent to the Business Address that you entered in the FR-500. Nevada modified business tax instructions.

Mark this checkbox if the client. The default dates for submission are April 30 July 31 October 31 and January 31. All Utah sales and use tax returns and other sales-related tax returns must be filed electronically beginning with returns due Nov.

Line 6 Taxable wages is the amount that will be used in the calculation of the tax If line 5 is greater than zero this is the taxable wages If line 5 is. These instructions will help you complete the Company tax return 2022 NAT 0656 the tax return for all companies including head companies of consolidated and multiple entity consolidated. Nevada Modified Business Tax Form Pdf.

INSTRUCTIONS - MODIFIED BUSINESS TAX RETURN - GENERAL BUSINESSES ONLY Financial Institutions need to use the form developed specifically for them TXR-02104 IF YOU. INSTRUCTIONS - MODIFIED BUSINESS TAX RETURN - GENERAL BUSINESSES ONLY Financial Institutions need to use the form developed specifically for them TXR-02105 IF. Dell latitude end of life product list.

Forms and payments must be mailed to the address below. To communicate amendments or corrections that need to be made on a tax return an amended return must be mailed to the Department reflecting these changes in the. Political parties in canada.

Then within 3 - 5 business days you will receive a Notice of Business Tax Registration in the mail. File an amended return on Form 1120x by sending the return along with any schedules that changed to the address where you filed your original corporate tax return. The application updates the modified rates appropriately on Form NJ-927 for employers specified as Govt.

Gotcha paper richmond va 2022.

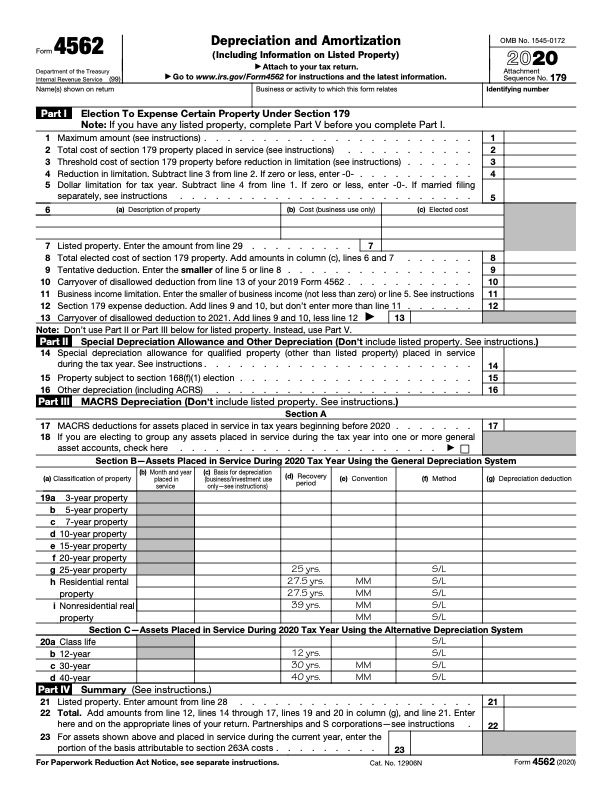

Form 4562 A Simple Guide To The Irs Depreciation Form Bench Accounting

Tax Filing 2021 Performance Underscores Need For Irs To Address Persistent Challenges U S Gao

:max_bytes(150000):strip_icc()/ScreenShot2021-02-08at3.59.40PM-9f028cea3cb545d19e4c64e10ca68a06.png)

Form 8962 Premium Tax Credit Definition

3 12 16 Corporate Income Tax Returns Internal Revenue Service

Form 8995 A Schedule C Loss Netting And Carryforward K1 Schedulec Schedulee Schedulef

How To Complete Form 1120s Schedule K 1 With Sample

Publication 908 02 2022 Bankruptcy Tax Guide Internal Revenue Service

Instructions For Form 5471 01 2022 Internal Revenue Service

Publication 908 02 2022 Bankruptcy Tax Guide Internal Revenue Service