do you have to pay sales tax when selling a used car

The most you can pay in state sales. You can avoid paying sales tax on a used car by meeting the exemption circumstances which include.

Should I Pay Cash For A New Or Used Car Kelley Blue Book

If you purchase your used car from a private seller.

. There are some circumstances where you must pay taxes on a car sale. If youre a buyer transferee or user who has title to or has a motor vehicle or trailer youre responsible for paying sales or use tax. Generally a dealership will help you deal with DMV-related fees such as your title transfer fee and registration fee.

Web What states do not have sales tax on used cars. If a vehicle is purchased from an Indiana dealership. Although a car is considered a capital asset when you originally purchase it.

Web Thankfully the solution to this dilemma is pretty simple. Montana Alaska Delaware Oregon and New Hampshire. When Do You Pay Sales Tax On A Used Car.

For example if you bought the two-year-old SUV for the original retail. Web Sales and Use Tax. Only five states do not have statewide sales taxes.

Web You will have to pay tax for buying a used car but there are certain conditions to that. Web The average sales tax rate on vehicle purchases in the United States is around 487. Web The amount owed in car sales tax will be clear on the purchase order thatll state your TTL tax title and licensing fees.

Web If you buy a car in New Jersey then youll need to pay sales tax and other fees when you transfer ownership. You do not need to pay sales tax when you are selling the vehicle. The buyer is responsible for paying the.

When you purchase a vehicle in Indiana you must pay sales tax on the purchase price of the vehicle. Web 625 sales or use tax. The most expensive standard sales tax rate on car purchases in general is found in.

Web The short answer is maybe. Web The main. Web Iowa collects a 5 state sales tax rate as a One-Time Registration Fee on the purchase of all vehicles.

Do you pay taxes on a car when you first buy it. You will register the. Web As listed by the Sales Tax Handbook the state imposes a 685 percent sales tax rate on customers for purchasing a vehicle.

Web You can determine the amount you are about to pay based on the Indiana excise tax table. If the dealer offers you 25000 for it you now owe the dealer the 20000 balance for the new car. Correct answer Yes you must pay vehicle sales tax when you buy a used car if you live in a.

Web Typically most states charge between 5 and 9 for their sales tax says Ronald Montoya senior consumer advice editor at Edmunds. Motor vehicle or trailer. In addition to taxes car purchases in Iowa may be subject to other fees.

Web You also want to trade in your old car. Web If you spend 7000 on a car and an additional 1000 on improvements but you sell the car for 7000 its considered a capital loss and you dont need to pay tax. Web How do I avoid sales tax on a car.

So if your used vehicle. That means youll be. If those conditions are not fulfilled you wont have to pay the tax but.

If You Need A New Car Buy It Before Trump S Tax Plan Goes Into Effect

Used Vehicle California Sales Tax And California Board Of Equalization

Sell Your Car In Cincinnati Oh Subaru Of Kings Automall

If I Buy A Car In Another State Where Do I Pay Sales Tax

Sales Taxes In The United States Wikipedia

How To Legally Avoid Car Sales Tax By Matthew Cheung Medium

Does The Seller Have To Pay Tax On A Vehicle When He Sells It

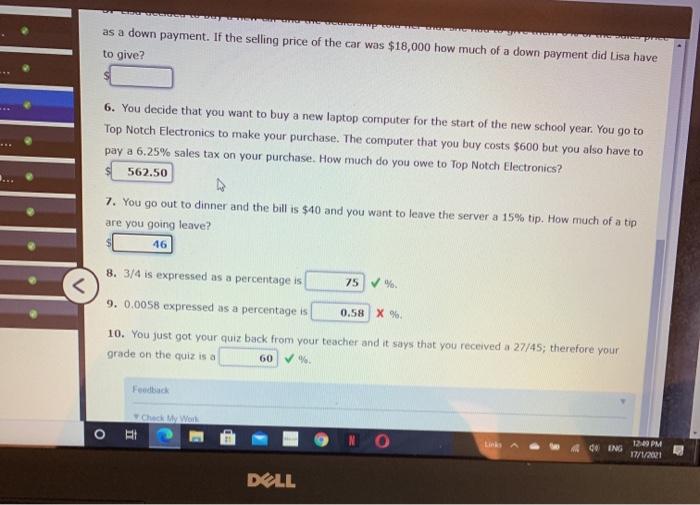

Solved As A Down Payment If The Selling Price Of The Car Chegg Com

If I Buy A Car In Another State Where Do I Pay Sales Tax

North Carolina 2022 Sales Tax Calculator Rate Lookup Tool Avalara

Understanding Taxes When Buying And Selling A Car Cargurus

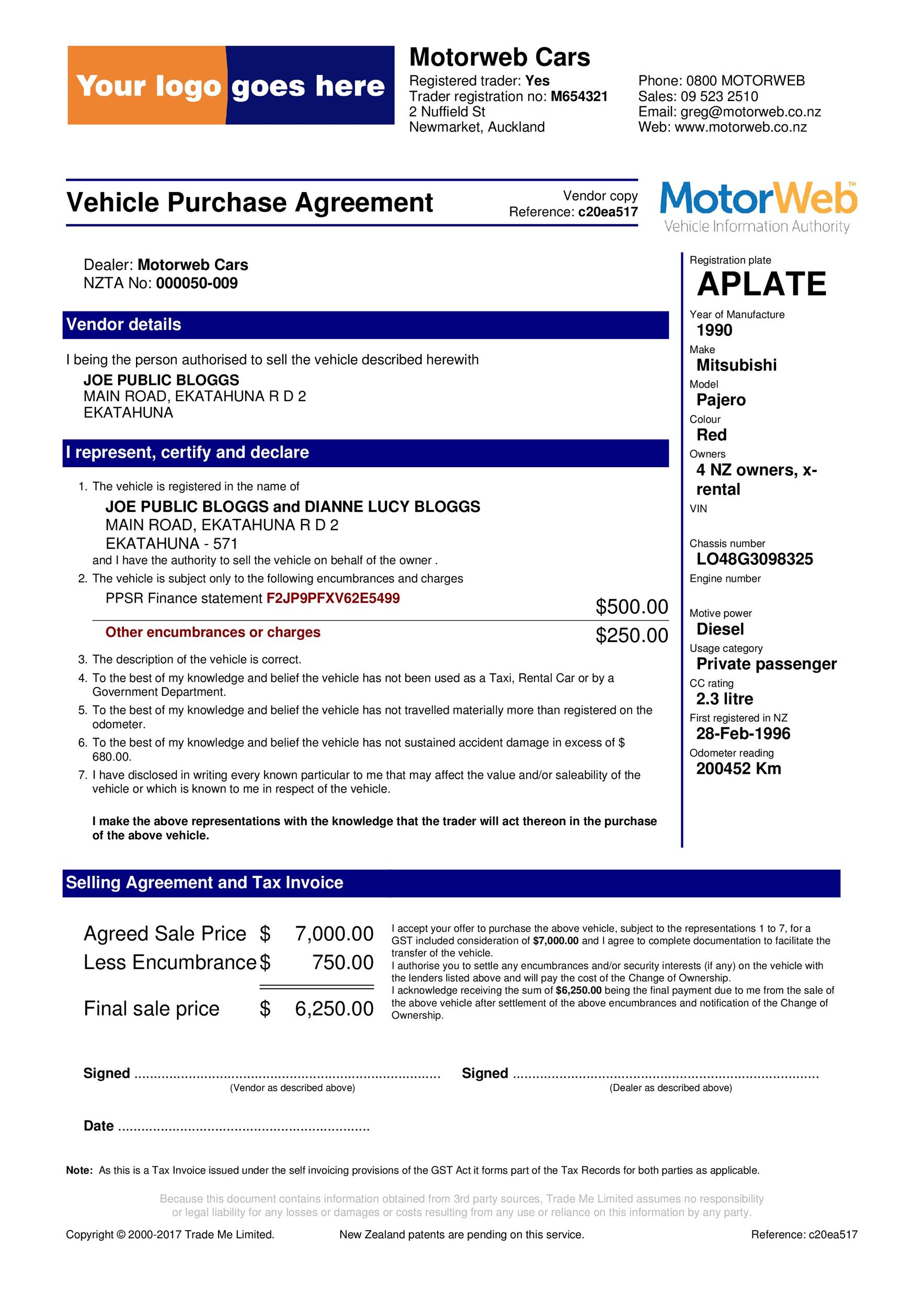

42 Printable Vehicle Purchase Agreement Templates ᐅ Templatelab

Selling To A Dealer Taxes And Other Considerations News Cars Com

If I Sell My Car Do I Pay Taxes All You Need To Know About Taxes When Selling A Vehicle

How To Sell Your Car What You Need To Know U S News

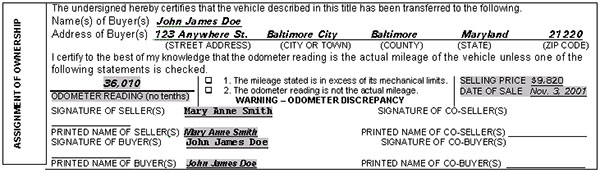

Buying A Vehicle In Maryland Pages

What To Know About Taxes When You Sell A Vehicle Carvana Blog

Sales Taxes In The United States Wikipedia

Illinois Imposing Car Trade In Tax On Jan 1 Dealers Call It Double Taxation